Do you know Sweden has one of the best Pension systems in the world , but only a few truly understands it.

Sweden has 3 Pension: (Refer Pension Triangle)

Allmäns Pension has 2 Parts : Inkomstpension and Premie Pension

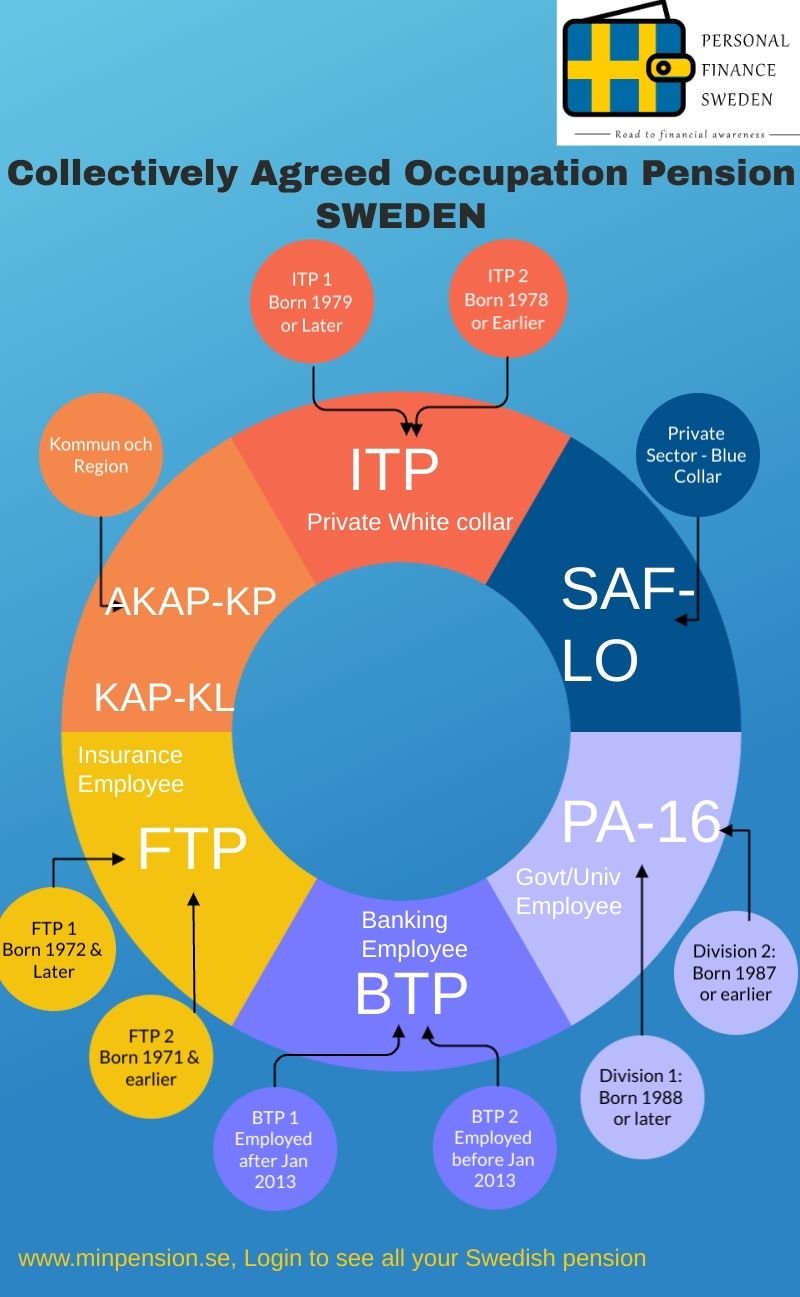

Occupation Pension : Collective Agreement or Non Collective agreement, Refer below for different types of Collective agreement Pension in Sweden

We can assist you further on topics:

Salary Exchange (Lönevaxling) : High income earner can move part of their Salary to Pension

Repayment Protection (återbetalningsskyd) : If you are no more, you pension goes to your family if this option is choosed (Read more Here)

Family Skydd : Kind of Life insurance

Investing your pension : We don’t provide advice on which funds to choose, we can have an overall view and discuss.

FAQ :

Q) Moving out of Sweden, Can I withdraw my Pension?

A) No , Very rarely Occupation Pension under certain condition can be taken out (Refer : Link)

I create awareness on personal finance topics to European Indian NRI and Swedish expats by empowering them to have control over their finances and a fulfilling life with happier relationship with money

Stay in touch with us.

[contact-form-7 id=”e6bb714″ title=”Home 2 (subscribe)”]