Person living in Sweden needs to report their global income and global loans to Skatteverket.

You can correct Previous 6 year tax in Sweden. Voluntary income reporting is encouraged and no tax surcharge in applied.

Important Concepts to Know:

- Tax surcharge are normally 40% of the tax amount which was evaded.

- If you correct an incorrect information in your income tax return on your own initiative, you cannot receive a tax surcharge. Nor can you be convicted of tax offences. (Read more: Link)

- A person who corrects an incorrect information on his or her own initiative also avoids criminal sanctions, i.e. is not convicted of a crime under the Tax Offences Act (Section 12 of Skattebrottslag (1971:69)

- Not reporting foreign income , can be consider as tax crime resulting in fine or imprisonment. Read more : Link

Skatteverket performed an random control of Foreign income and around 50% people misreported their foreign income, Read more here

Exchange of Information between Countries happen via CRS (OECD countries) and DAC 2 (EU Directive) : Read more : Skatteverket

Benefits for expats who are residents in Sweden & paying taxes to Sweden have the option to claim various deductions which they have missed to claim in previous years like:

- Double Accommodation Deduction: Moved to Sweden for a job and hold an apartment in your home country or moved within in Sweden for a job and hold an apartment in previous location, Great ! , You are Eligible to deduct Sweden rent. Read more : Dubbel Bosättning

- Fixed Term Employment Deduction: Moved to Sweden or within Sweden for a job with fixed-term employment. Eligible to deduct Sweden rent. It can be a 6-month probation period on your job contract as well. Most people working in PhD /Post Doc /Researcher / ICT visa fall under this category. Note the rent shall be paid by you ONLY and not by your company. Read more: Temporary work deduction

- Interest Repaid on Loans (Home Country): Interest repaid for loans can be deducted in Sweden taxes. Any loans (foreign country education loan also) can be claimed until the year 2024. In 2025, personal loans can be deducted with 50% paid interest only. From 2026, non-collateral loan interest deduction shall be removed. Read more: Interest Deduction

To claim a deduction in a specific year, you need to be a tax resident in Sweden and have paid taxes to Sweden in that year.

You have to report global income (anywhere in the world) also to Sweden:

- Bank interest income

- Sale of stocks/funds or RSU/ESOP

- Sale of apartment

- Income from Dividends, Rental income and others

We have assisted more than 50+ people and so far claimed back from taxes more than 2 million Kr

- 210,000 Kr for double accommodation deduction for 5 years – For a Person moved from outside EU to Sweden for Job in Sweden, Family stayed in Previous place.

- 160,000 Kr for home loan interest repaid for last 5 years – For a person who was repaying interest to bank in thier home country

- We have claimed deductions and money received by expats for more than 1 million Kr.

- Reported international income such as Bank interest, Dividends, apartment sale & stock sale – Reported income and tax paid was more than 1 Million Kr

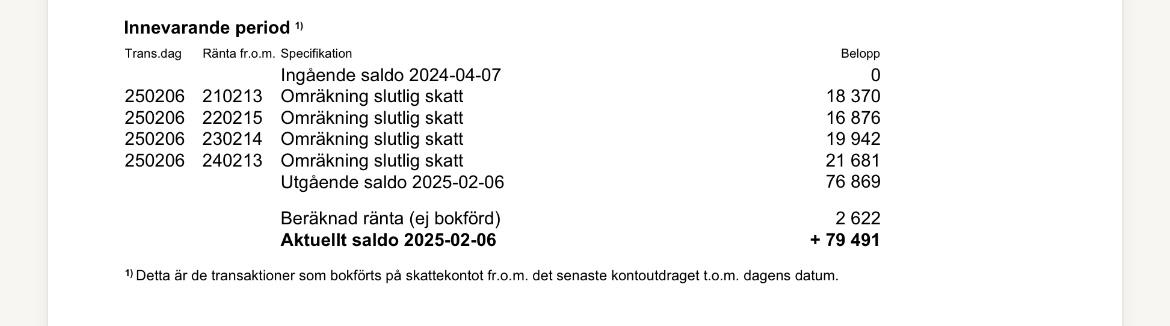

- Sample proof below where the claim for international loan deduction for previous 4 years was approved and the person received back 79 491 Kr.

Many people lack awareness of this topic and fail to report the income or claim deductions. Now, we have a wonderful opportunity to correct our taxes in Sweden for the last 6 years.

Many people lack awareness of this topic and fail to report the income or claim deductions. Now, we have a wonderful opportunity to correct our taxes in Sweden for the last 6 years.

Interested in knowing more and whether you have the opportunity to use this service?

Let’s have a quick 10-minute initial meeting to discus, Note: This meeting shall be handled by Tanusha Motivaras.

Hourly rates are 600 Kr/hour.